N.Y. Times April 13, 2023 analysis regarding the state of inflation.

This Times chart reveals that gasoline prices have dropped 17%.

Remove Gasoline from the contributing list of inflation factors and Inflation increases from 5% to 5.5%.

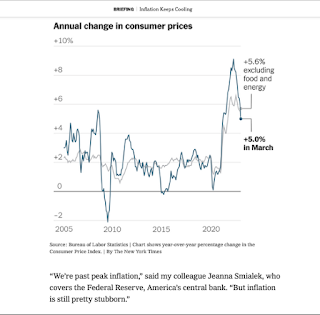

Another Times Chart reveals...

that the simultaneous shutting down of the economy because of COVID restrictions followed by Biden whispering into the camera, "I got you 1.9 trillion" apparently created such an alarm from the FED they acted soon after.

But, as the Times Article states, "There is a risk that the FED does too little and inflation persists...or, there is the risk the FED goes too far and does unnecessary damage to the economy, aka, THE PEOPLE.

How does ratcheting up credit card interest rates help those who already have debt, fight inflation? How does forcing Americans to buy less while their overall debt increases, fight inflation? Since when is inflation fought by increasing debt among Americans?

The FED needs to reevaluate how their actions are adversely affecting Americans with credit card debt and Seniors who were planning on using a Reverse Mortgage to supplement their monthly income.

If Credit Card Companies raise their interest rates to discourage too much borrowing, then Credit Card companies MUST ALSO reduce credit card interest rates on existing credit card debt so mutually beneficial agendas are achieved. Existing consumer credit card debt requires a significant interest rate reductions as future purchases are reduced by increasing interest rate charges on new purchases.

Many Americans with Credit Card Debt are being punished by an incomplete Credit Card policy. Seniors who were hoping to use a Reverse Mortgage to get by, in essence rewarding themselves for being responsible and building up their home equity, are now discovering their low interest mortgage (courtesy of Donald Trump era policies) MUST BE PAID OFF and REPLACED with a higher interest rate Reverse Mortgage. Reverse Mortgage Loan expenses into the thousands that have compounded interest assigned to them, plus mortgage insurance, result in a huge reduction in Reverse Mortgage benefits.

Reverse Mortgage benefits have been severely compromised because the FED has raised interest rates several percentage points. Retirees could easily be losing an extra thousand dollars a month in compounding interest rate charges, or, find they can only tap half the amount they could have tapped just a scant year ago!

Banks have been blindsided by the FED's rapid increase in interest rates. Banks that less than a year go were paying 1% percent interest or less on savings accounts, are now offering 4% or higher.

Government based entitlements are drying up as COVID restrictions are ending and the annual U.S. military budget spikes.

The American people are being spurned and deceived by the FED's interest rate hikes that lack the accompanying humanity that needs to be a part of any "corrective" economic action the FED has already initiated.

No comments:

Post a Comment